Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

5 (103) In stock

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Ohio Corporate Bylaws - Northwest Registered Agent

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)

5 Steps to Forming a 501(c)(3) Nonprofit Corporation

Most Common Lawsuits for Nonprofits - Emplicity PEO & HR Outsourcing

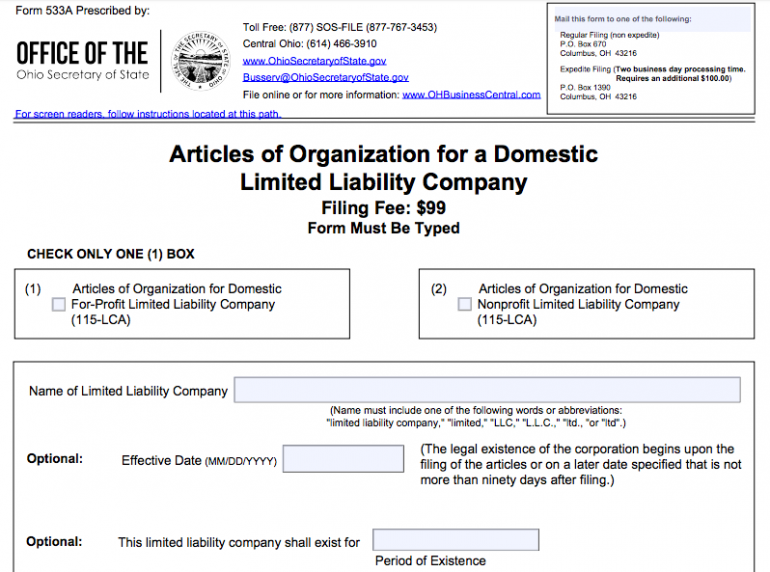

Forming an LLC in Ohio: A Step-by-Step Guide - NerdWallet

Starting a Charity in Ohio - CHARITABLE OHIO

Ohio Northern University Ohio Northern University

How to Start a Nonprofit in Ohio

Electing Pass-Through Entity: IT 4738

2024 State Income Tax Rates and Brackets

Not For Profits - FRSCPA, PLLC

Terms of Service Nonprofit Expert

Nonprofit Branding: Our Complete Guide and Best Examples

Non-Profit CRM Software Online Donor Relationship Management System - Zoho CRM

ADIDAS LEGGINGS LEGGINGS HL0026, SCHWARZ, 16,99 EUR, Hosen

ADIDAS LEGGINGS LEGGINGS HL0026, SCHWARZ, 16,99 EUR, Hosen How to Wash Your Period Underwear: A Comprehensive Guide – HealthFab

How to Wash Your Period Underwear: A Comprehensive Guide – HealthFab Pink Ruffle Lace Choker, Pink Frilly Choker, Pink Frilly Doll Princess Choker, LGBT Choker, Transgender Choker,

Pink Ruffle Lace Choker, Pink Frilly Choker, Pink Frilly Doll Princess Choker, LGBT Choker, Transgender Choker, Style Bae Styling Doll - Dylan, Kids Toys for Ages 3 Up, Gifts and

Style Bae Styling Doll - Dylan, Kids Toys for Ages 3 Up, Gifts and Royal leggings with pretty pattern cut and lined in mesh

Royal leggings with pretty pattern cut and lined in mesh/product/18/9539762/2.jpg?5382) Fashion Women's Shapewear Tops Wear Your Own Bra Long Sleeve Slim Crop Top Body Arm Shape Slimming Underwear

Fashion Women's Shapewear Tops Wear Your Own Bra Long Sleeve Slim Crop Top Body Arm Shape Slimming Underwear